Why a Credit Card Debt Attorney is Your Best Option

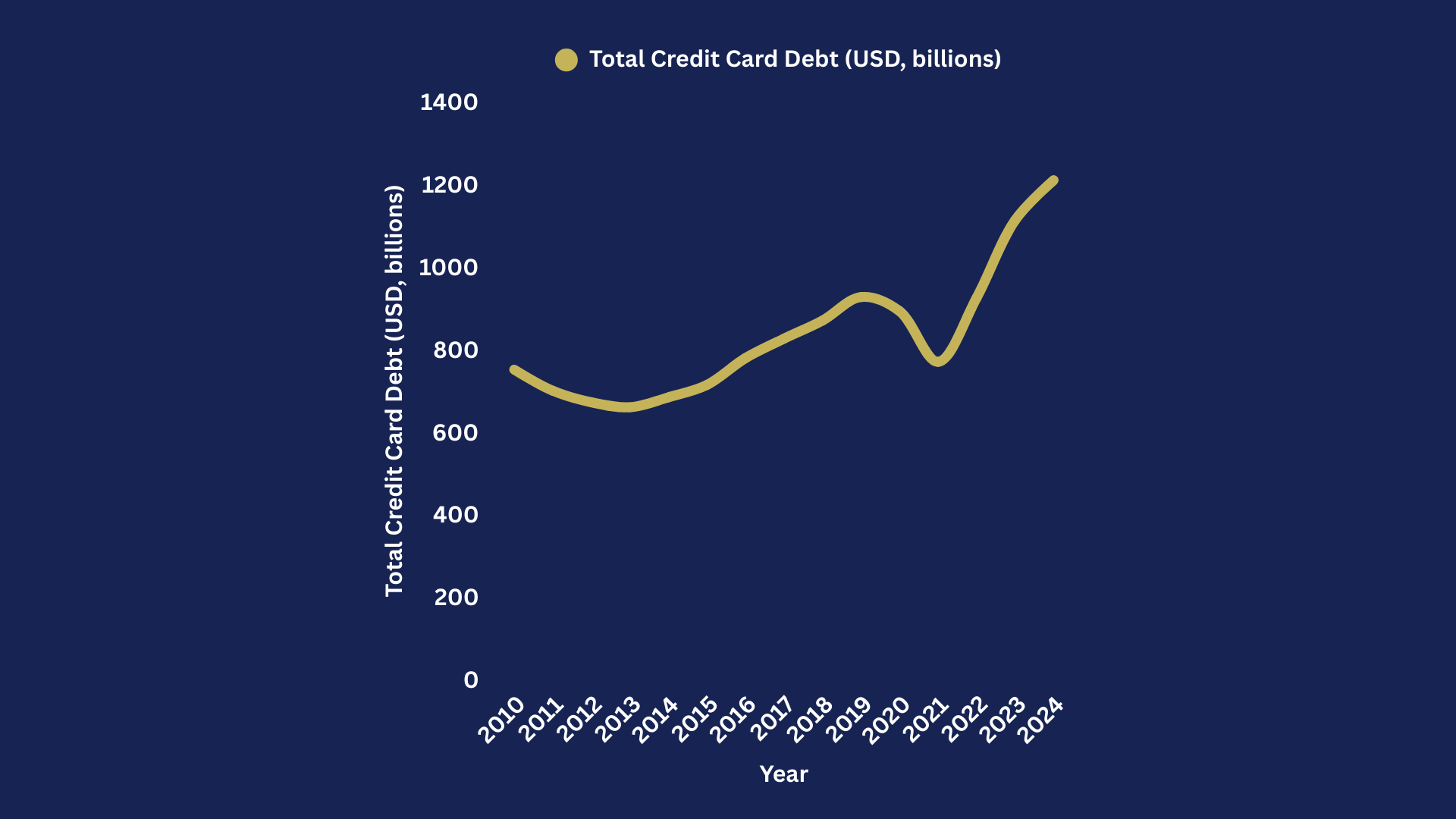

A credit card debt attorney can be a trusted ally when you’re struggling with mounting credit card bills and aggressive collectors. Credit card debt is a growing problem in America. As of early 2025, Americans owed over $1.21 trillion on their credit cards, the highest amount ever recorded according to the latest quarterly report from the Federal Reserve. This upward trend shows no signs of slowing down.

If you need help, then don’t wait. Contact Wilkie Puchi LLP today for a free consultation and gain control of your credit card debt situation. Our experienced attorneys are here to review your situation confidentially and help you take the right steps toward financial peace.

To see just how dramatically balances have climbed since 2020, take a look at the 15-year trend shown here which illustrates the steady rise of credit card debt in the United States year after year.

If credit card debt feels unmanageable and you’re wondering whether hiring a credit card debt attorney is right for you, this article may help. We’ll explain what a credit card debt attorney does, when you should consider hiring one, and how to find the right attorney for credit card debt help. Whether you’re searching for a “credit card debt attorney near me” or need help with business credit card debt, understanding your options can make a big difference.

What Does a Credit Card Debt Attorney Do?

A credit card debt attorney helps people and businesses deal with credit card debt issues. They specialize in defending clients against lawsuits, negotiating with creditors, and protecting rights under laws like the Fair Debt Collection Practices Act (FDCPA). They are sometimes referred to as debt collection defense attorneys or debt defense attorneys, as they focus on stopping unfair collection tactics.

Benefits of Hiring a Credit Card Debt Attorney:

Defending you if you’re sued for unpaid credit card debt.

Negotiating settlements or payment plans to reduce what you owe.

Stopping harassing calls or illegal collection practices.

They use legal strategies such as checking if the debt is too old to collect (statute of limitations), verifying the debt amount, or proving the creditor doesn’t have the right to sue. This expertise can protect you from unfair treatment and costly mistakes.

For many middle-class families, dealing with rising credit card debt can feel overwhelming and stressful. You might be juggling work, family, and bills, with little time or energy left to sort through confusing legal paperwork or negotiate with aggressive collectors. This is where a credit card debt attorney can be especially valuable. Their experience with debt laws and negotiation means they can often find a fair solution faster than you could on your own, helping you avoid costly mistakes or unnecessary court battles. By letting a professional handle the legal details, you can save time, reduce stress, and often lower your overall costs as a result. Having someone in your corner who knows the system can make the path to resolving your debt much smoother and less intimidating.

When Should You Hire a Credit Card Debt Attorney?

Not everyone with credit card debt needs a lawyer, but there are clear signs that it’s time to get one. Review the signs below to see if any of them apply to you.

Signs to Hire an Attorney

You receive a lawsuit or court summons for credit card debt.

Debt collectors are constantly calling or threatening you.

Your wages or bank accounts are at risk of garnishment or levy.

You own a business and face credit card debt issues related to your company.

Hiring a debt defense attorney or credit card debt attorney can help stop harassment, protect your rights, and possibly reduce your debt. They can negotiate on your behalf and represent you in court if needed. In some cases they can help get a credit card lawsuit dismissed. For business owners, a business debt attorney understands the complexities of commercial debt and can help protect your business assets. Is it better to settle a debt or go to court? Settling is generally the route you want to take but not every situation is the same. This is a great question to ask during your initial consultation.

Keep in mind, no attorney can guarantee a specific outcome, but having a skilled attorney on your side improves your chances of a better result.

If you’re unsure whether your situation calls for hiring a credit card debt attorney, it’s a good idea to seek a free consultation with Wilkie Puchi LLP. Our team understands that every financial situation is unique, and sometimes it’s hard to know if legal help is necessary. During a free consultation, our attorneys will listen to your concerns, review your circumstances, and offer straightforward advice based on years of trusted legal experience. This way, you can get a clear understanding of your options without any pressure or obligation, and make an informed decision about your next steps.

How to Find the Right Credit Card Debt Attorney Near You

Many people start by searching for a “credit card debt attorney near me” on their favorite search engine, but you don’t have to limit your search to credit card debt lawyers in your own zip code. Thanks to modern technology, finding the right business debt attorney is easier than ever before, even if they aren’t located right down the street.

Today, you can find and connect with a qualified attorney for credit card debt using just your phone or computer. Most law firms, including Wilkie Puchi LLP, offer free consultations by phone or video call. This means you can talk to a debt collection defense attorney from the comfort of your home.

Video calls make it easy to meet face-to-face without having to travel. Secure online messaging lets you send documents and ask questions at any time. This is especially helpful if you’re busy with work, family, or running a business. If you need a business debt attorney, you can get expert help no matter where you are located in your state.

Working with an attorney for credit card debt online can save you time and often help keep legal fees lower. Without the need for in-person meetings or travel, attorneys can offer more flexible pricing and faster service. You get the legal help you need, when you need it, without extra hassle.

So, if you’re searching for a “credit card debt attorney near me,” remember that the best attorney for your situation might be just a video call away. Take advantage of free consultations and online convenience to get the support you deserve.

Take Control of Your Debt Today

When you’re feeling overwhelmed, a debt collection defense attorney can help you understand your rights and options. Whether you’re facing personal debt or business credit card debt, having an experienced debt defense attorney can make a real difference. Wilkie Puchi LLP is ready to assist so contact us today by visiting our contact page.